Overdraft Protection

As a convenience to our checking account members, Goldenwest offers an overdraft protection program named "Courtesy Pay".

With Courtesy Pay, Goldenwest will pay a transaction even when you have insufficient funds in your checking account. To enjoy Courtesy Pay on your VISA debit card, you are required to opt-in.

-

How much does it cost?

The Courtesy Pay program is free. Goldenwest allows members up to $1000 in monthly Courtesy Pay transactions. Each Courtesy Pay transaction incurs a $22 fee. If you never use the program, you never pay a fee.

-

Why should I opt-in?

Goldenwest may deny your VISA debit card purchases if our records indicate insufficient funds in your checking account and you have not opted-in to the Courtesy Pay program. Please note that members are automatically enrolled in the Courtesy Pay program for paper checks, ACH and re-occurring debit transactions.

You may opt-in to the Courtesy Pay program for VISA debit card purchases by:

Visiting any Goldenwest branch;

Contacting our member contact center at 801-621-4550 or 800-283-4550

Should you have any questions regarding Courtesy Pay, please contact us at 801-621-4550 or 800-283-4550. Or, submit questions or concerns at courtesypay@gwcu.org. -

Understanding Your Account Balance for Overdrafts

Your checking account has two kinds of balances: the “actual” balance and the “available” balance. You can check both balances when you view your account online, at an ATM, calling the audio branch, contacting the member contact center, and at any branch location. Goldenwest uses the available balance to determine if a transaction will cause your account to overdraw, and for assessing overdraft fees.

The information below explains greater detail how your checking account balance works – including the difference between your actual balance and your available balance.

-

Your Actual Balance

Your actual balance is the amount of money in your account at any given time. The actual balance reflects transactions that have “posted” to your account. However, it does not include transactions that have been authorized and are pending. While it may seem the actual balance is the most up-to-date display of the funds that you can spend from your account, this is not always the case. Your account may have purchases, holds, fees, other charges, or deposits made on your account that have not posted and, therefore, will not appear in your actual balance.

-

Your Available Balance

Your available balance is the amount of money in your account available to you without incurring an overdraft fee. Your available balance takes into account transactions on-hold for deposits and withdrawals (such as pending debit card transactions) that have been authorized but have not yet posted to your account.

-

Example of Overdraft Fee for Insufficient Available Balance

If your actual balance and available balance are both $100, and you swipe your debit card at a restaurant for $35, a hold is placed on your account resulting in your available balance reduced to $65. Your actual balance remains $100 because the transaction has not posted to your account. If a check you had previously written for $75 clears through your account before the restaurant charge for $35 is sent to Goldenwest for processing, you will incur an overdraft fee. Why? Your available balance was $65 when the $75 check was paid. In this case, Goldenwest may pay the $75 check and charge you an overdraft fee of $22. In addition, the $22overdraft fee will be deducted from your account, further reducing your checking account balance.

-

Alternatives to Overdraft Protection

Goldenwestoffers alternative overdraft protection by linking your checking account to a line of credit and/or other deposit account. When accounts are linked, funds are automatically transferred at no cost to you, unless a line of credit loan is linked to your checking account. You may have interest charges if you link your checking account to a line of credit. You can opt out of overdraft protection at any time.

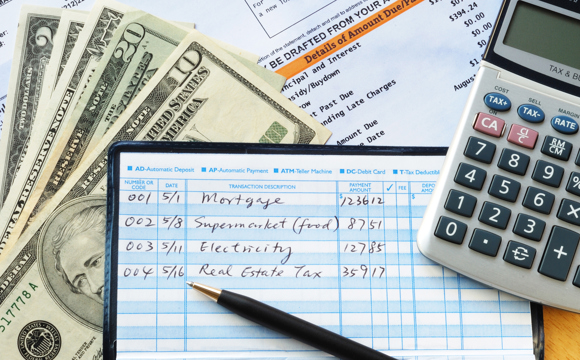

You can avoid overdraft charges by managing your checking account responsibly. By recording deposits, withdrawals and other transactions in your check register, you will have a better understanding of how much money is available in your checking account. Remember to record ACH and ATM transactions, bill pay payments, and debit transactions along with incurred fees.

Routinely review your checking account activity. You may do so by reconciling your statements, logging-in to the online or mobile branch, visiting an ATM, or by calling the credit union. Remember, some transactions may not have cleared your account, so knowing your account activity at all times will help protect you from an overdraft situation.