Kids & Finances

Washing the dishes, mowing the lawn, and folding the laundry are all viable ways for a 12-year-old to earn an allowance. According to the American Institute of CPA's, 61 percent of parents pay an allowance to their kids, with the average allowance being $65 a month, or $780 per year. So what happens to the hard-earned cash once it's in the hands of the eager 12-year-old? According to Money Magazine, by age 13, most financial habits have formed. If you're a parent who wants to put your child on the right track for a bright financial future, you don't have time to lose. Consider the following tips for instilling sound financial practices:

Set the example. Your kids watch everything you do, so show them how you live within your financial means by involving them in the family budgeting process. Don't be reluctant to tell your children that going to a movie this month is not in the family budget. Take time to explain cutting-back on "extras" such as entertainment or eating-out will allow the family to enjoy a summer vacation. Even if it isn't, your children will take mental note and hopefully implement similar budgeting practices in their future adult lives.

Allow them to learn from mistakes. How many times has one of your children "lost" their money, or spent their money on a frivolous item only to regret it later? Bailing them out could be detrimental to their future financial habits. Sympathy and a listening ear may do your son or daughter more long-term good than a monetary loan or gift.

Establish realistic expectations. The chances of your 8 year-old investing in mutual funds with their hard-earned money are slim-to-none. A more likely scenario is they will buy over-priced junk without your approval. Giving your child flexibility to make purchase decisions is an important part of the learning process. Just make sure the allowance amount isn't greater than your tolerance for an occasional unwise decision.

Start a savings account. An excellent tool to help teach your children how to save is by establishing their own personal savings account. At Goldenwest Credit Union, you can open and maintain a savings account with as little as five dollars. If one of your children has their sights set on a big-ticket item, help them establish a plan that includes regular deposits into their savings account. Go online to review the account frequently to track their progress, including interest earned.

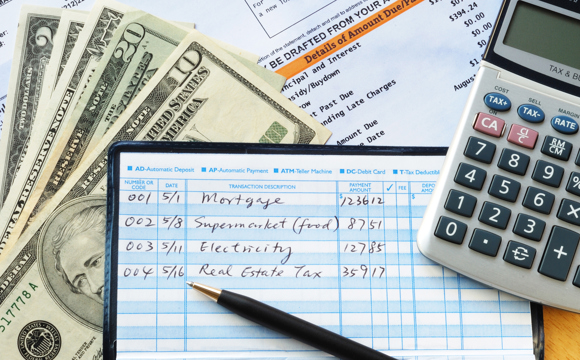

Teach them to manage a checking account. If you're serious about preparing your teenager for their financial future, one of the best actions you can take as a parent is helping them open a checking account with a debit card. Teach them to track their spending. Don't wait until your child goes off to college or embarks on missionary service to open a checking account with hopes that they will figure it out for themselves. If you're concerned your son or daughter may not be ready for a checking account with a debit card, start with a Goldenwest Visa Reload Card to ease-in to the managing finances with an electronic payment system.

Consider family financial literacy an investment in the future. Good financial habits that are formed at an early age can provide countless benefits to your children (and you) throughout their lives.

Author: Goldenwest Credit Union